Renting vs Buying: Which Can You Actually Afford?

The decision between renting and buying a home is one of the biggest financial choices most people face. With rising prices changing interest rates and shifting job market’s the renting vs buying cost comparison is more important than ever. If you are unsure which option fits your real life budget this guide breaks down every major factor from monthly expenses to long term wealth potential so you can make a confident and informed decision.

1. The Modern Affordability Dilemma

The housing market has changed dramatically in the past decade. Rent has increased in most cities, but buying has also become more expensive due to higher home prices and pledge rates. That’s why a realistic renting vs buying cost comparison is the first step before making any long term commitment.

This article will help you understand your total monthly cost the opportunity cost of your down payment and the situations where buying actually makes financial sense.

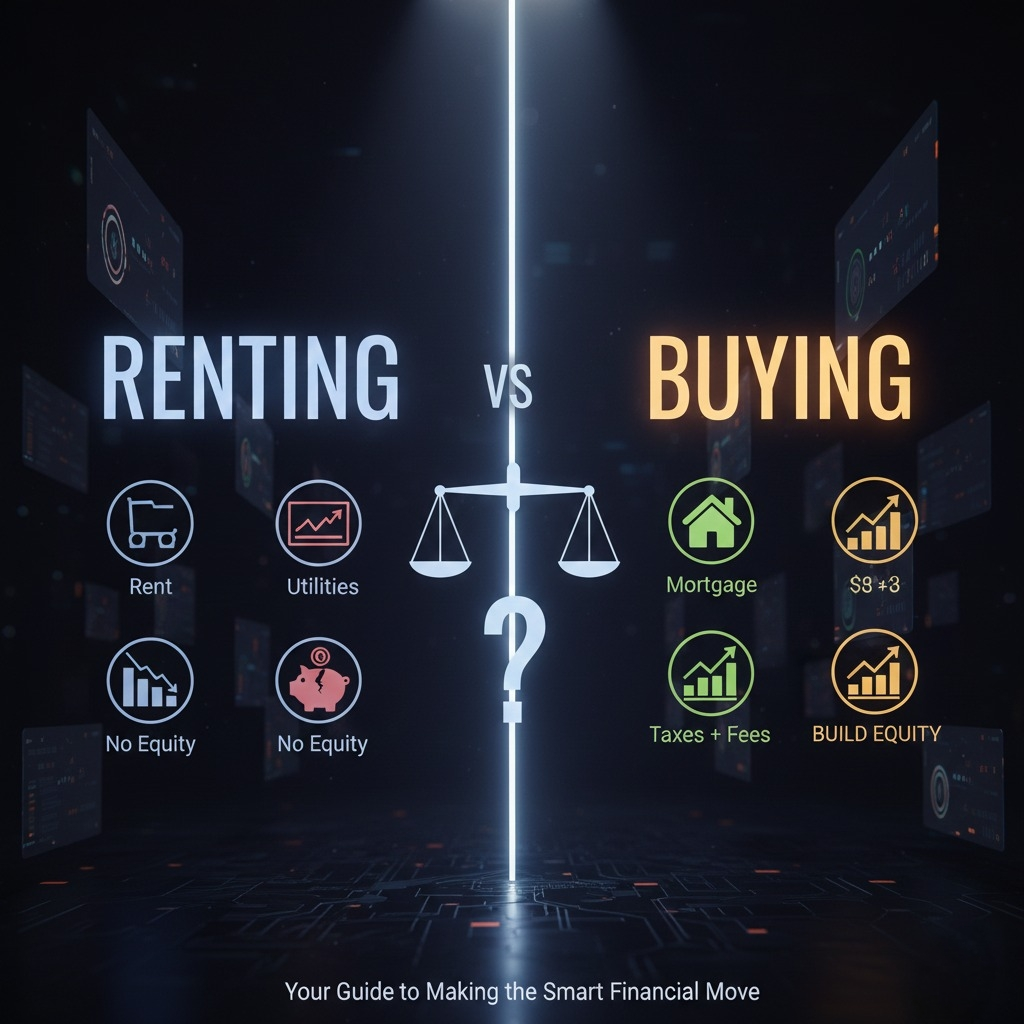

2. Renting vs. Buying: A Quick Overview

When people start a renting vs buying cost comparison, they usually focus on surface evel numbers monthly rent vs. pledge. But the difference goes far deeper.

- Renting: Lower commitment, more flexibility

- Buying: Higher responsibility but potential long-term equity

- Renting: Minimal maintenance

- Buying: Asset ownership and stability

Understanding these basics helps you analyze the detailed renting vs buying cost comparison more accurately.

3. Compare Total Monthly Costs (Mortgage vs. Rent)

This is the section where the renting vs buying cost comparison becomes very clear. Mortgage payments include multiple components:

Mortgage Monthly Expenses

- Principal

- Interest

- Property taxes

- Homeowners insurance

- HOA fees (when applicable)

- Maintenance and repairs

Most first time buyers underestimate these costs which can distort their renting vs buying cost comparison.

Rent Monthly Expenses

Renters typically pay:

- Monthly rent

- Renter’s insurance

- Utilities (depending on lease terms)

While rent seems simpler it increases over time unlike a fixed rate pledge. This factor plays a big role in the long term renting vs buying cost comparison.

4. The Opportunity Cost of Your Down Payment

A solid renting vs buying cost comparison must consider what your down payment could earn if invested elsewhere.

If you put ₹10 lakh or $20,000 into a home down payment, you lose the chance to grow that money in:

- Index funds

- Retirement accounts

- High-yield savings

- A side business

This “missed growth” is the opportunity cost.

For example, investing the same amount at 7% annual return can grow significantly over 10 years sometimes more than home equity growth especially if property appreciation is slow. That’s why the opportunity cost is a critical part of a proper renting vs buying cost comparison.

5. When Buying Makes Financial Sense

Buying a home becomes smarter than renting when several long-term financial factors align. The deeper your renting vs buying cost comparison, the clearer these scenarios become.

Buying makes sense when:

- You plan to stay in the home at least 5–7 years

- Your mortgage payment stays lower than rising rent

- Property values in your area consistently appreciate

- You want the stability of fixed payments

- You prefer building equity rather than paying a landlord

Buying becomes a powerful forced savings strategy. Over time your equity grows creating long term wealth that renting cannot provide which is why many people shift their renting vs buying cost comparison toward ownership.

6. The Lifestyle Factor: Beyond the Numbers

Not every renting vs buying cost comparison is purely financial. Lifestyle plays a big role too.

Renting is ideal if:

- You want flexibility

- You may relocate

- You prefer not dealing with repairs

Buying is ideal if:

- You want roots and stability

- You enjoy customizing your space

- You prefer growing long-term assets

Even if buying is slightly more expensive lifestyle benefits may tilt your personal renting vs buying cost comparison toward ownership.

7. Affordability Checklist: Are You Ready to Buy a Home?

Before you end your renting vs buying cost comparison evaluate your financial readiness.

✔ Income stability

✔ Good credit score

✔ Emergency fund (3–6 months)

✔ Low debt-to-income ratio

✔ Ability to handle hidden homeownership costs

Hidden expenses like repairs appliances and maintenance often surprise first time buyers. Including them in your renting vs buying cost comparison prevents unexpected financial strain later.

8. Case Studies: Real Examples

To make the renting vs buying cost comparison clearer here are simple scenarios:

1. Young professional in a metro city

- High rent but extremely high home prices

- Renting is often more practical

2. Family shifting to suburbs

- Lower home prices

- Mortgage may be cheaper than rent

- Buying becomes smarter long-term

3. Remote worker moving to a low-cost area

- Affordable homes

- Ownership gives stability

- Buying often wins the renting vs buying cost comparison

These examples show how personal situations change the outcome.

9. Final Verdict: Which Option Can You Afford?

After doing a complete renting vs buying cost comparison the right choice depends on your:

- Monthly budget

- Long-term plans

- Down payment flexibility

- Risk tolerance

- Lifestyle preferences

If total ownership cost (including hidden expenses) fits comfortably within your budget, buying may be the smarter move. But if flexibility mobility or cash flow is your priority renting remains the better choice.

10. Conclusion

The renting vs buying cost comparison is not just about monthly payments it is about your goals, lifestyle, and financial future. Take time to calculate your real numbers evaluate your stability and understand where you see yourself in the next five years.

Once you compare both options with clarity you will know exactly what you can afford and what will set you up for long term financial peace.