First-Time Homebuyer Budget Checklist:

Your Complete 1400+ Word Guide

Buying your first home is a major milestone one filled with excitement stress numbers and paperwork. The biggest challenge for most buyers is not finding the perfect home; it is understanding the financial steps required to afford one comfortably. That’s exactly why you need a clear and practical homebuyer budget checklist. This checklist keeps you organized prepared and financially confident at every stage of the journey.

When you are a first time buyer every rupee or dollar matters. From down payments to closing fees inspections to maintenance and pledge terms to credit scores your success depends on building a strong financial plan for buying house. Without that structure you risk overspending facing surprise costs or stretching your budget too thin.

This comprehensive guide walks you through everything: setting your budget organizing your finances tracking your expenses preparing for hidden costs and avoiding common mistakes beginner buyer’s often make.

1. Why Every First-Time Buyer Must Use a Homebuyer Budget Checklist

Most first-time buyers believe the house price is the only major cost they should care about. That’s a dangerous assumption. A real estate purchase includes dozens of financial components and a proper homebuyer budget checklist ensures nothing is missed.

A strong financial plan for buying house helps you:

- Know exactly what you can afford

- Avoid loan rejections

- Prevent lifestyle strain after purchase

- Be ready for mortgage-related changes

- Choose the right financing options

- Stay protected from hidden or unexpected costs

Without this structure even financially stable buyers can end up house poor spending most of their income on home expenses and struggling with daily needs.

2. Step-by-Step Financial Prep Guide

This is the essential roadmap you need before purchasing your first property. Each step strengthens your financial plan for buying house and ensures your decisions are data driven rather than emotional.

2.1 Evaluate Your Current Financial Health

Every smart homebuyer budget checklist starts with a full financial audit. Before looking at listings or lenders you must understand where you stand today.

Review:

- Monthly income (salary, business, freelance, passive income)

- Total monthly expenses (rent, utilities, subscriptions, food, travel)

- Debts (credit cards, loans, EMIs)

- Savings (emergency fund, investments, home fund)

- Your spending habits

This audit helps you identify unnecessary expenses and adjust your lifestyle to strengthen your financial plan for buying house.

2.2 Determine Your Home Affordability Range

This is one of the most important parts of your homebuyer budget checklist. Most financial advisers recommend the 28/36 rule:

- No more than 28% of your monthly income should go to mortgage payments

- No more than 36% of your income should go to total debt payments

Following this helps maintain a stable financial plan for buying house and avoids overleveraging yourself.

You should also consider:

- Local market prices

- Interest rate trends

- Your employment stability

- Possible future income changes

2.3 Estimate Upfront Costs

Upfront costs are often shocking for first time buyers. These must be included in your homebuyer budget checklist to avoid last minute financial panic.

Essential upfront expenses:

- Down payment: Usually 5%, 10%, or 20% of home price

- Closing costs: 2%–5% of the property value

- Inspection fees: Structural, pest, general inspection

- Appraisal fees: Required by lenders

- Legal charges: Lawyer or registration fees

- Moving expenses

- Initial repairs or upgrades

These costs play a huge role in your financial plan for buying house because many buyers only save for the down payment and forget the rest.

2.4 Plan for Monthly Ownership Costs

Mortgage payments are only the beginning. A complete homebuyer budget checklist includes all recurring costs so they do not surprise you.

Monthly/Yearly costs include:

- Property taxes

- Homeowners insurance

- HOA or society maintenance fees

- Utilities (water, electricity, gas, internet)

- Routine repairs (plumbing, appliances, paint)

- Emergency repairs (roof leaks, electrical issues)

- Mortgage insurance (if applicable)

A well prepared financial plan for buying house always includes a buffer fund for unexpected home related emergencies.

3. Budget Template for Income, Savings, and Debts

Your budget template brings together everything in one clean functional sheet. You can use Google Sheets Excel or any budgeting app.

3.1 Income Breakdown Template

Include:

- Main job income

- Side income sources

- Occasional earnings

- Bonuses or commissions

The income section of your homebuyer budget checklist helps you understand your exact cash flow for affordability purposes.

3.2 Savings Breakdown Template

List:

- Emergency fund

- Existing savings

- Home purchase fund

- Maintenance fund

- Health + retirement savings

Every strong financial plan for buying house includes long term savings not just short term goals.

3.3 Debt & EMI Breakdown

Record:

- Credit cards

- Student loans

- Personal loans

- Vehicle loans

- Consumer EMIs

Your debt to income ratio (DTI) is a key factor lenders evaluate. A good homebuyer budget checklist tracks this before you apply for a pledge.

3.4 Complete Budget Template Summary

Your final template should include:

- Total income

- Total expenses

- Total debt

- Savings available

- Estimated home affordability

- Emergency buffer

Keeping this updated ensures your financial plan for buying house remains accurate throughout the process.

4. Common Financial Mistakes First-Time Buyers Make

Even prepared buyers often fall into traps. This section helps you avoid the mistakes that can derail your homebuyer budget checklist.

4.1 Underestimating Hidden Costs

Things like property registration insurance upgrades and maintenance can cost more than expected. Not including them weakens your financial plan for buying house from day one.

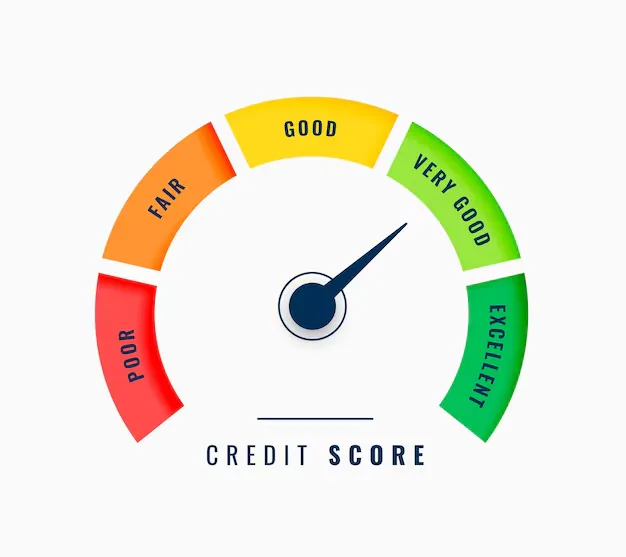

4.2 Ignoring Credit Score Importance

A good credit score reduces your interest rate. A bad one makes your home extremely expensive over time. A wise homebuyer budget checklist always includes credit score improvement before applying for a pledge.

4.3 Not Getting Pre-Approved Before House Hunting

Pre-approval shows exactly how much lenders are willing to finance. Without it your financial plan for buying house remains incomplete and risky.

4.4 Not Planning Emergency Funds

Home repairs can hit when you least expect. Skipping emergency savings is a common mistake that destroys budgets. A homebuyer budget checklist should always include a repair fund equal to at least 1% of your home value annually.

4.5 Focusing Only on the Listing Price

A house with a low price may come with high taxes poor insulation or expensive HOA fees. These can ruin your financial plan for buying house if not accounted for.

5. How to Stay Financially Ready During the Homebuying Process

Buying a home takes months. Keeping your finances stable through the journey is essential for a strong homebuyer budget checklist.

Here’s how:

- Recalculate your budget monthly

- Don’t take new loans or EMIs

- Maintain your savings discipline

- Compare mortgage types and interest rates

- Avoid big purchases during loan processing

- Keep updating your financial plan for buying house with new market information

The more consistent you are the smoother your approval process becomes.

6. Conclusion

Owning your first home is a life changing achievement but only when done with preparation and clarity. A detailed homebuyer budget checklist protects you from stress surprise costs and long term financial strain. It helps you stay organized take smarter decisions and approach homeownership with full confidence.

A strong financial plan for buying house ensures you do not just buy a home you buy it without sacrificing your lifestyle stability or peace of mind. With the right planning the right budget and the right knowledge your dream home becomes a realistic achievable goal.